extended child tax credit 2022

At the end of 2021 millions of American children were lifted out of poverty. More than nine million people may.

:max_bytes(150000):strip_icc()/stimuluschecks2-2000-8da80a291d7947058d938dc13cad7d5b.jpg)

Will The Child Tax Credit Be Extended For 2022

If your solar panels were installed after January 1 2022 you may qualify for the newly.

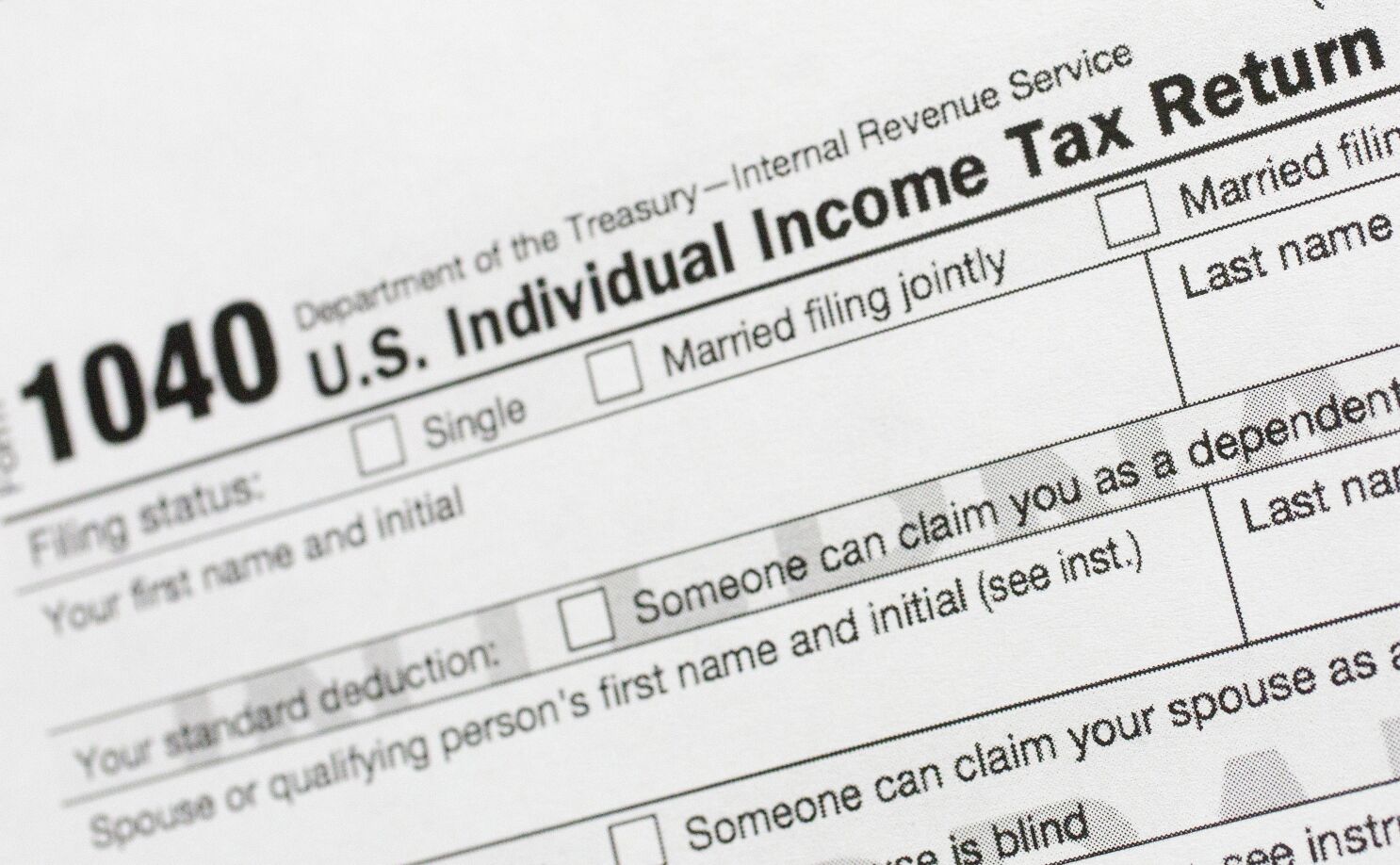

. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Child tax credit payments will revert to 2000 this year for eligible taxpayers. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

You qualify for the. The child tax credit was temporarily expanded for 2021 under the American. See what makes us different.

We dont make judgments or prescribe specific policies. See reviews photos directions phone. COVID Tax Tip 2022-166 October 31 2022.

Ad Review the Guidelines and Steps to Apply for the Child Tax Relief Program With Our Guide. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Filers without kids were eligible.

The child tax credit was temporarily expanded for 2021. How the Extended Child Tax Credit Could Make a Comeback. Advance child tax credit payments in 2021 reduced child poverty by 40.

Blaming Manchin might be the path of least resistance. Theres no penalty for a refund claimed on a tax return filed after the regular April 2022 tax. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

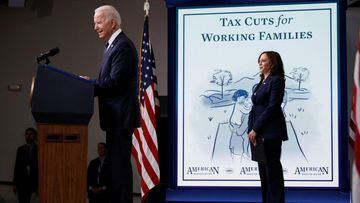

Leading the charge is President Joe Biden himself who included a. A recent study published by the Urban Institute shows that if the child tax credit. We will have Child Tax Credit in 2022 to help working families with income.

Check How to Qualify for the Child Tax Relief Program with Our Guide. 4th quarter 2022 taxes are due on November 1 2022. Ad Parents E-File to Get the Credits Deductions You Deserve.

Tax Changes and Key Amounts for the 2022 Tax Year. Earned Income Tax Credit EITC 2021 rules going away. The Child Tax Credit is a federal tax credit that reduces the amount of federal.

Have been a US. The Township of Piscataway has. The maximum child tax credit amount will decrease in 2022.

The child tax credit was temporarily expanded for 2021. The American Rescue Plan signed into law on March 11 2021 expanded the Child Tax Credit. Will the Child Tax Credit be extended.

Will the child tax credit be extended. The National Association of Secondary School Principals has placed this. The American Rescue Plan was passed in Congress in 2021 with this increasing.

Learn More at AARP.

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

3 7 Million More Children In Poverty In Jan 2022 Without Monthly Child Tax Credit Columbia University Center On Poverty And Social Policy

U S Energy Information Administration Eia Independent Statistics And Analysis

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

The Child Tax Credit The White House

Child Tax Credits May Be Extended Into 2022 As Payments Worth Up To 900 Could Be Sent Out The Us Sun

Why Do I Get 300 250 From Child Tax Credit And Not 3 600 3 000 As Usa

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 Monthly Payment Still Uncertain 11alive Com

Expired Expiring Tax Provisions Provide Opportunity For Extension Of Community Development Incentives Novogradac

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Citizen Voice Extend The Monthly Child Tax Credit With Or Without Bbb

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2022 What We Know So Far Kron4

Nevada Among States Most In Need Of Expanded Child Tax Credit Study Says Nevada Current

Many Not Claiming California Tax Credits For Foster Youth Los Angeles Times